Roku Investment Thesis & Valuation Model

The TV Operating System: "The streaming wars are playing out on our turf".

The Most important thing

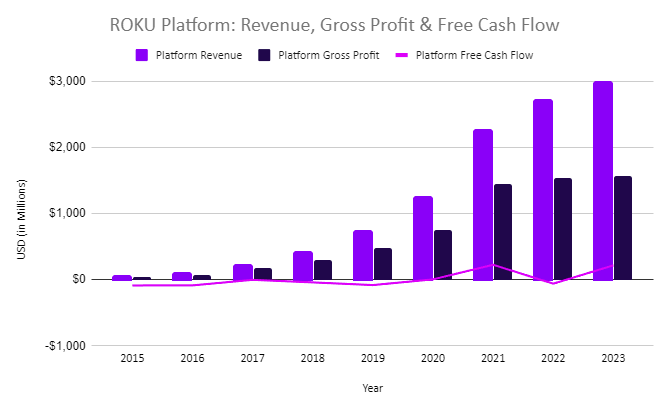

The Cost of Revenue (CoR) is simply a fixed percentage of overall revenue in most companies - the cost of producing a good or service. Roku however has far more embedded in this figure which is only revealed beneath the covers of the annual report (10K). Roku’s accounting choice to include The Roku Channel’s (TRC) content costs in CoR could lead some investors to believe that Roku’s platform business is structurally unattractive. To me, the current level of content spending as a % of revenue serves Roku as a powerful lever to increase operating leverage (gross profit margins) over time.

Cost of Revenue, Platform Cost of revenue, platform primarily consists of costs associated with acquiring advertising inventory and amortization costs of content, both licensed and produced, and revenue share with content partners. Cost of revenue, platform also includes other costs such as payment processing fees, allocated expenses associated with the delivery of our services that primarily include costs of third-party cloud services and salaries, benefits, and stock-based compensation for our customer support and platform operations personnel, and amortization of acquired developed technology.

Gross Profit Margins are approaching a trough:

Amortization of Content Assets:

2021 - $95.6M

2022 - $234.4M

2023 - $207.9M

Two indicators of future content amortization are:

Licensed & produced content commitments:

2021 - $421M

2022 - $393M

2023 - $286M

Content Assets, Net (Reflected on the Balance Sheet):

2021 - $223.7M

2022 - $292.8M

2023 - $257.4M

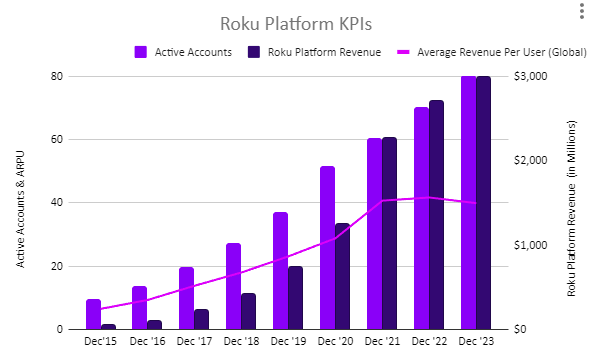

As platform revenue (Active Users * ARPU) continues to rise , and as leadership keeps upfront content investment flat, platform gross profit margins are poised to inflect. 🙂

A renewed focus on monetization

The Roku platform is working to increase both the accessibility and monetization rates for its advertising inventory by leaning further into the programmatic pipelines of the open internet. Roku has demonstrated an ability to structure revenue-sharing deals with publishers for AVOD-supported content. This generally aligns the content owners with the platform and has the added benefit of requiring less upfront capital commitment for original content production & media content licensing. By monitoring the allocation of platform revenues redeployed into original content and leveraging AVOD revenue-sharing agreements, Roku could enjoy significantly lower upfront costs to pay publishers & content producers for The Roku Channel content. For a more detailed overview of the overall CTV market, feel free to check out my earlier post entitled Roku - Lead Husky in the Decade of Streaming.

“The streaming wars are not happening to Roku. We’re not in the streaming wars. The streaming wars are playing out on our platform.” - Charlie Collier, Roku Media President

Looking forward, Roku has win: win frameworks to monetize publisher content fueled by marketing budgets flowing into Free Ad-supported Television (FAST) content. This alternative structure for content monetization could open Pandora’s box resulting in a substantial inflow of publisher content onboarding to The Roku Channel. By removing the limiting factor for Roku of capital investment to publishers upfront, revenue-sharing agreements perfectly align incentives between Roku and all publishers looking for incremental profit on their evergreen libraries of content. This positions Roku to become the default AVOD content platform for publisher content both within the Roku operating system and extending across other TV Operating Systems (TVOS) through The Roku Channel App.

Roku’s Revenue Source Breakdown:

Platform revenue near Roku’s IPO in 2017 was below 45% of revenue. Today the platform revenue is eclipsing 85% of the total revenue and is incrementally climbing as a percentage. Because Player Gross Margins hover around breakeven - to me, this segment is essentially written off as a customer acquisition vehicle. Essentially this indicates that the Platform Revenue is now the sole contributor of Gross Profit to the business and therefore Roku’s KPIs are tied to its’ Platform segment.

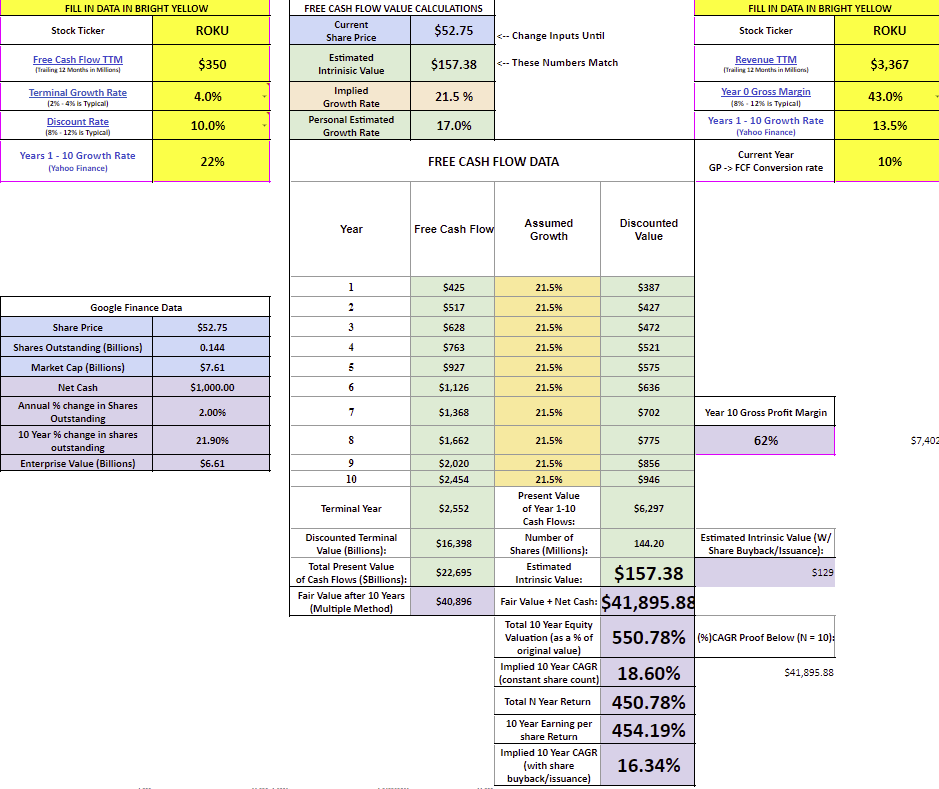

If you are interested in reviewing all the embedded assumptions, please feel free to check out my free Roku Discounted Cash Flow Model!

Total Addressable Market (TAM):

"Data gathered on the global television market showed that there were 1.7 billion TV households worldwide in 2019, up from 1.67 billion in the previous year." - Statista

At the end of 4Q2023, Roku has roughly 80M active users of the TVOS. The runway for adoption of the Roku Operating System is long and the formula for future profits is simple:

Roku Platform Revenue = Active Users * ARPU

Go-To-Market Strategy:

To me, the long-term strategy would be capturing more users onto its TV operating system (OS) by accelerating content acquisition while simultaneously selling devices at cost or at a loss to be the lowest friction option. Roku continues to sign TV OS licensing deals with manufacturers native to geographic regions followed by onboarding compelling native language content libraries onto The Roku Channel. Onboarding SVOD and AVOD content partnerships in languages native to the regions for which they are expanding is key. Free ad-supported content is the future of TV and Roku is the leading platform in the regions for which they operate. While Roku has had the ability to be cash flow positive since 3Q’2020, we should keep an eye on how management decides to invest this high-margin platform revenue over time.

For now, they continue to deploy nearly every dollar back into enhancing the content library of TRC. In the future, both improved deal structures & scale could allow substantial free cash flow to fall to the bottom line.

Disclosure: At the time of publication, I hold shares of Roku Inc.